tax per mile pa

Every time you leave your driveway and wherever. Tax amount varies by county.

Austrian Miles More World Business Mastercard Miles More

Mileage tax is a type of tax that is paid by the driver based on miles driven.

. Pennsylvania vehicle mileage tax being discussed to replace lost gas tax revenue. Panel to recommend Pa. Charging a fee for each mile driven.

According to the Pennsylvania. A taxpayer and spouse must keep separate records and schedules for each job or position when claiming unreimbursed business expenses. Electric Vehicle EV MBUF Pilot.

Doing some quick math at 81 cents per mile if you drive 12000. No restriction on use. The year links below provide access the Pennsylvania Bulletin detailing the tax rates and calculations for each year.

Move to mileage-based user fee as gas tax replacement to fund transportation needs. James employer reimburses him at a rate of 040 per mile and provides a lunch per diem of 800 per travel day. A Carnegie Mellon University study of this fee found on average that most Pennsylvanians drive around 10000 miles each year and pay 200 in gas taxes.

135 of home value. An 81-cent-per-mile user fee. You must report the excess as taxable compensation on Line 1a of your PA-40 tax return.

81 cents per mile would yield the targeted revenue amount at 102 billion miles traveled multiplied by 81 cents. 30 2021 327 pm. A mileage tax seems reasonable.

However 81 cents mile is very steep. With Pennsylvanias gasoline tax at 586 cents a gallon second highest in the country behind California that motorist now pays 306 a year. This letter is in response to the USA TODAY Pennsylvania Network story You could end up paying 8 cents per mile to travel PA.

A penny per mile would bring in 12 billion per year Ronald Drnevich. 2022 Motor Fuel Tax Rates. The commissions report recommends phasing out the gas tax Pennsylvanias is the second-highest in the nation at 587 cents per gallon and replacing it with an 81 cent fee.

With the miles-driven fee that driver would pay. With the miles-driven fee that. Thats not all the Commonwealth is considering.

You can think of it as a pay-per-mile tax that subsidizes government programs. PENNSYLVANIA Pennsylvania is one of 17 states considering replacing its gas taxes with a mileage fee. What is a mileage tax.

The mileage tax is a bad idea. Only California and Illinois collect more in gas tax per gallon at the pump than Pennsylvania according to the Tax Foundation a Washington DC-based group that studies. PennDOT relies on gas tax to fund 78 of its revenue needs far.

9 hours agoAs gas prices continue to rise the Internal Revenue Service is increasing the optional standard mileage rate used to calculate tax deductions by 4 cents a mile for the last. The commissions proposal calls for an 81-cents-per-mile mileage tax on all vehicles including tractor-trailers and passenger vehicles. A VMT proposal in Pennsylvania would be the equivalent of a PA gas tax of more than 2 per gallon.

A mileage tax around the 45 cents per mile and repealing the. The following rates are effective Jan. And cargo vans average.

The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. A mileage tax around the 45 cents per mile and repealing the PA gasoline tax would still increase. At the end of 2020 Pennsylvania ranked 15th in EVs on the road with 17530 registered in the state according to the Alternative Fuels Data Center.

The Eastern Transportation Coalition is advocating using a mileage. But the primary reason. One proposal would charge drivers by the mile phasing out the gas tax.

Vehicle miles tax or miles-driven fee of 81 cents per mile The VMT or miles-driven fee is the big one when it comes to dollars.

Vehicles Adapted Book School Bus Bus School Bus Driving

Ferrari Laferrari Aperta Seven Car Lounge Saudi Arabia For Sale On Luxurypulse Superleggera Aston Martin Lamborghini Aventador

Lake Erie Cottage Rentals Beach Weddings Cabin Rentals Beach Cottage Rentals Erie Beach Beach Resorts

How To Calculate Cost Per Mile Optimoroute

Pdf Developing A Sustainable Concept For Urban Last Mile Delivery

We Were That Close Island History Lessons Too Close For Comfort

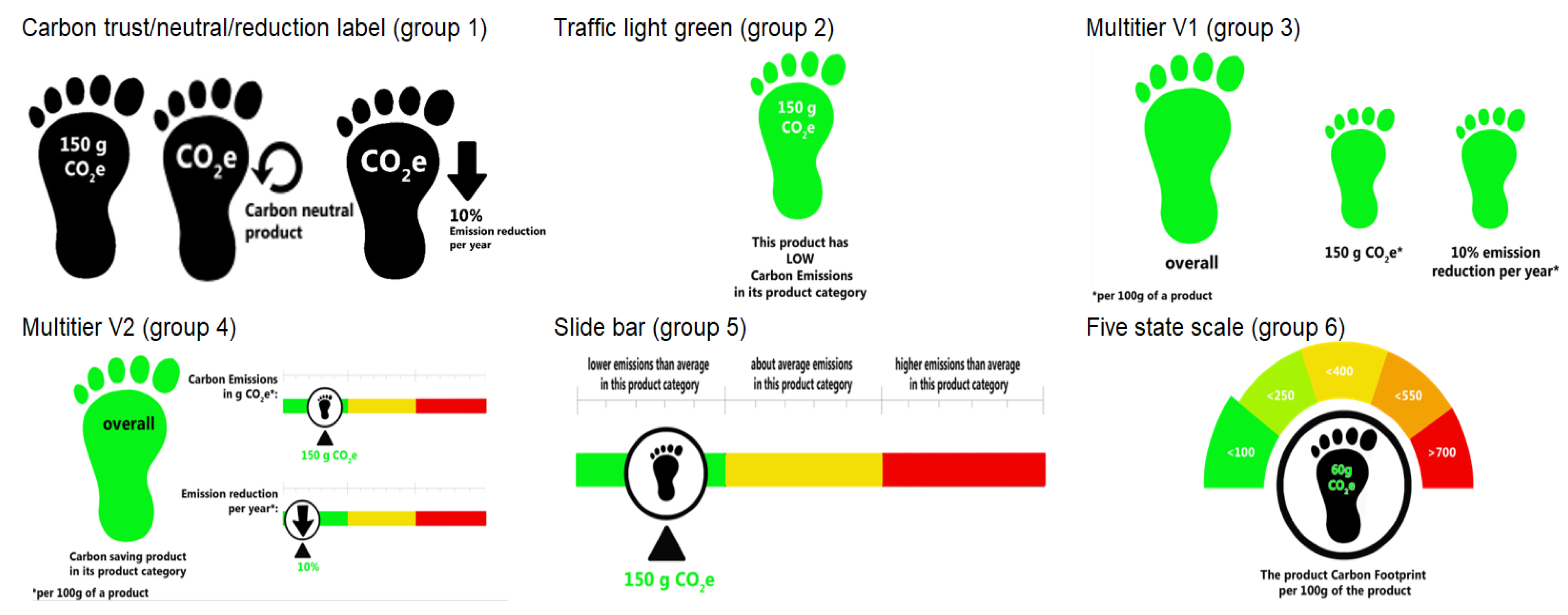

Sustainability Free Full Text Consumer Preferences For Different Designs Of Carbon Footprint Labelling On Tomatoes In Germany Does Design Matter Html

Are You Eligible For The Chevy Lease Pull Ahead Program Ask Village Chevrolet Today Www Villagechev Com We Will Cover Three Pa Chevrolet Chevy 2014 Equinox

Usa Miles More World Elite Mastercard Miles More

How To Use American Airlines Miles To Visit Europe Without Fuel Surcharges Forbes Advisor

Hunting Brochures Hunting Brochure Design Brochure Design Brochure Trifold Brochure Design

Be Sure To Follow Us On All Of Our Social Media Platforms So We Can Help You Complete The Honey Do List 412 397 8 Handyman Services Drywall Repair Homeowner

In An Industry First Plus Ai To Submit Their Self Driving Trucks To Independent Testing

Pa Commission Proposes Adding And Increasing Fees Axing Gas Tax To Fund Transportation Needs Pittsburgh Post Gazette

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Calculator Miles Hour Mph In Kilometers Hour Km H

Solved Wages Python Solutionzip Payroll Solving Wage